san francisco sales tax rate history

This is the total of state county and city sales tax rates. Notes to Rate History Table.

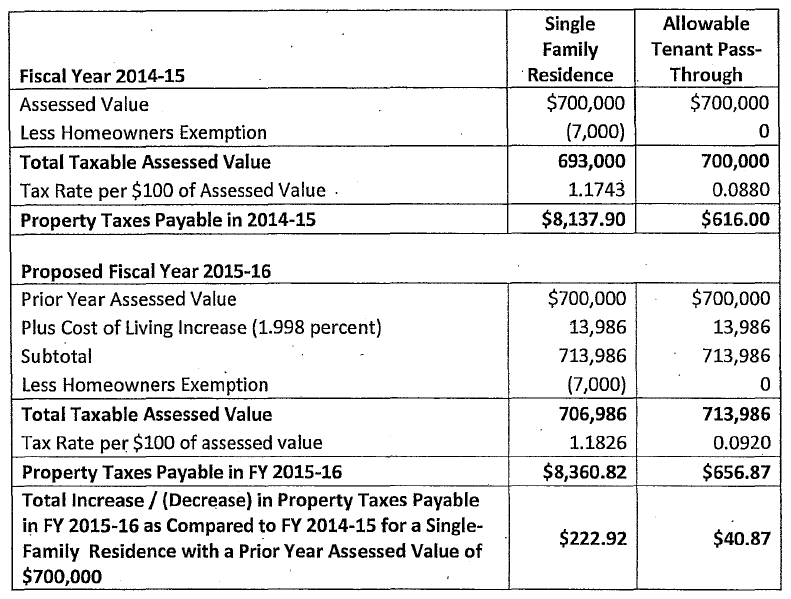

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

The minimum combined 2022 sales tax rate for San Francisco California is.

. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer. SOLD MAY 20 2022. The estimated 2022 sales tax rate for 94107 is.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The December 2020 total local sales tax rate was 8500. For a list of your current and historical rates go to the.

The minimum combined sales tax rate for San Francisco California is 85. These rates may be outdated. The average cumulative sales tax rate in San Francisco California is 864.

Learn about the Citys property taxes. Effective January 1 2013. The December 2020 total local sales tax rate was 9750.

What is the sales tax rate in San Francisco California. San Francisco has parts of it located within. Rates are for total sales tax levied in the City County of San Francisco.

This is the total of state county and city sales tax rates. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida. The current total local sales tax rate in South San Francisco CA is 9875.

Has impacted many state nexus laws and sales tax collection. 1788 rows California City County Sales Use Tax Rates effective October 1 2022. The 9875 sales tax rate in South San Francisco consists of 6 Puerto Rico state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

The current total local sales tax rate in San Francisco County CA is 8625. The transfer tax rate had been previously unchanged since 1967. 2310000 Last Sold Price.

Citys General Fund Local Portion is 1 of the total rate throughout the period shown. The law authorizes counties to impose a sales and use. Historical Tax Rates in California Cities Counties.

The California sales tax rate is currently 6. There is no applicable city tax. Rates are for total sales tax levied in the City County of San Francisco.

This scorecard presents timely. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955. The 2018 United States Supreme Court decision in South Dakota v.

The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. This includes the rates on the state county city and special levels. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

The 8625 sales tax rate in San Francisco consists of 6 Puerto Rico state sales tax 025 San Francisco County sales tax and 2375 Special tax. The current total local sales tax rate in San Francisco CA is 8625. Nearby homes similar to 108 Albion St have recently sold between 1250K to 9000K at an average of 465 per square foot.

0875 lower than the maximum sales tax in CA. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. The December 2020 total local sales tax rate was 8500.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Local Income Taxes In 2019 Local Income Tax City County Level

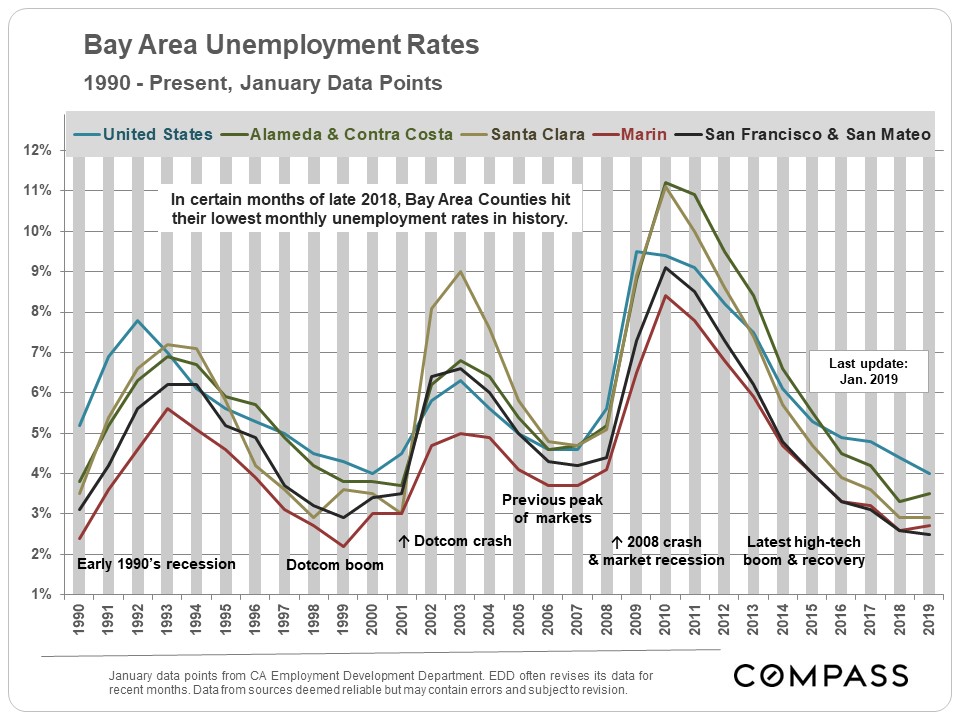

30 Years Of Bay Area Real Estate Cycles Compass Compass

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How Do State And Local Sales Taxes Work Tax Policy Center

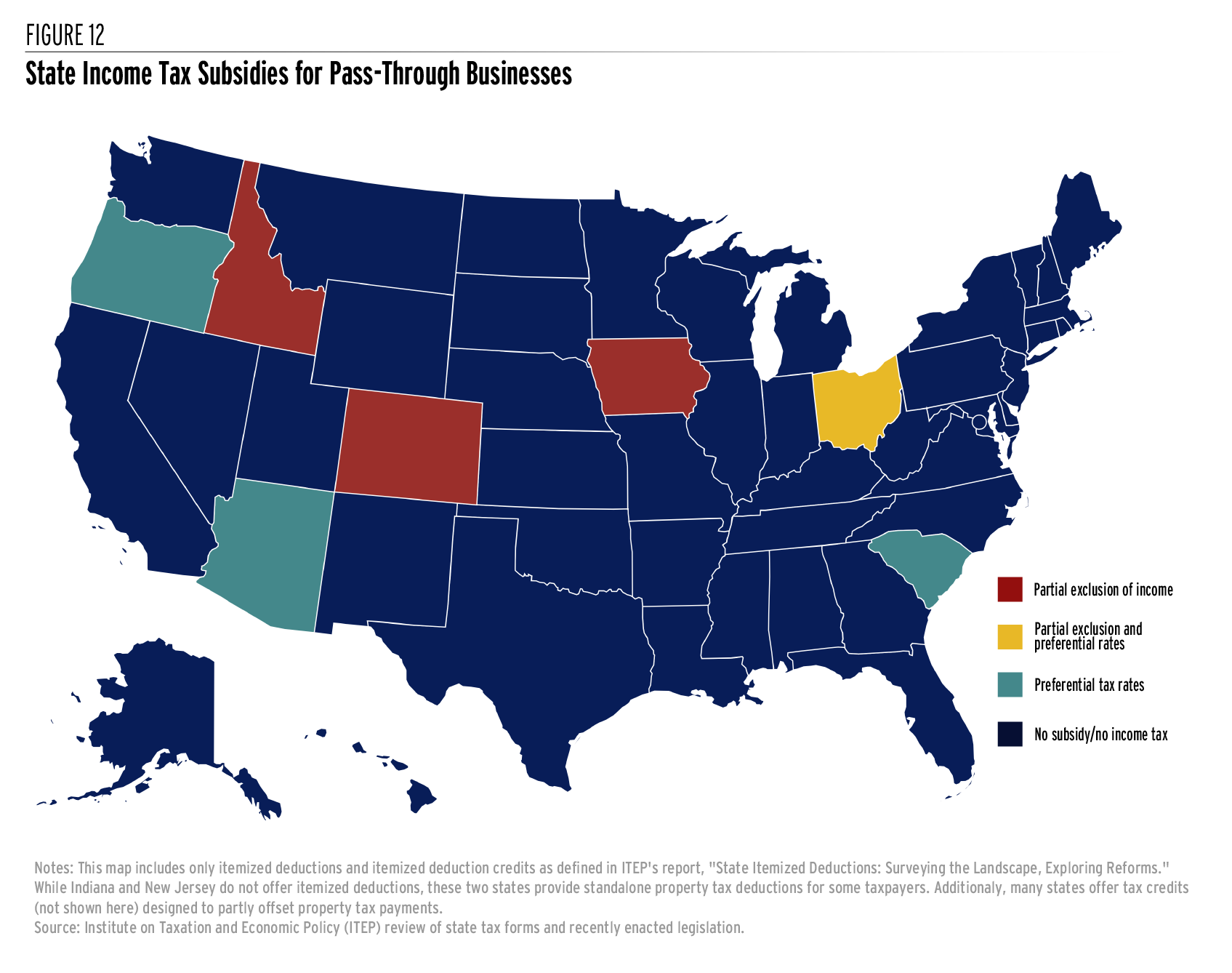

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Most And Least Tax Friendly Major Cities In America

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Understanding California S Property Taxes

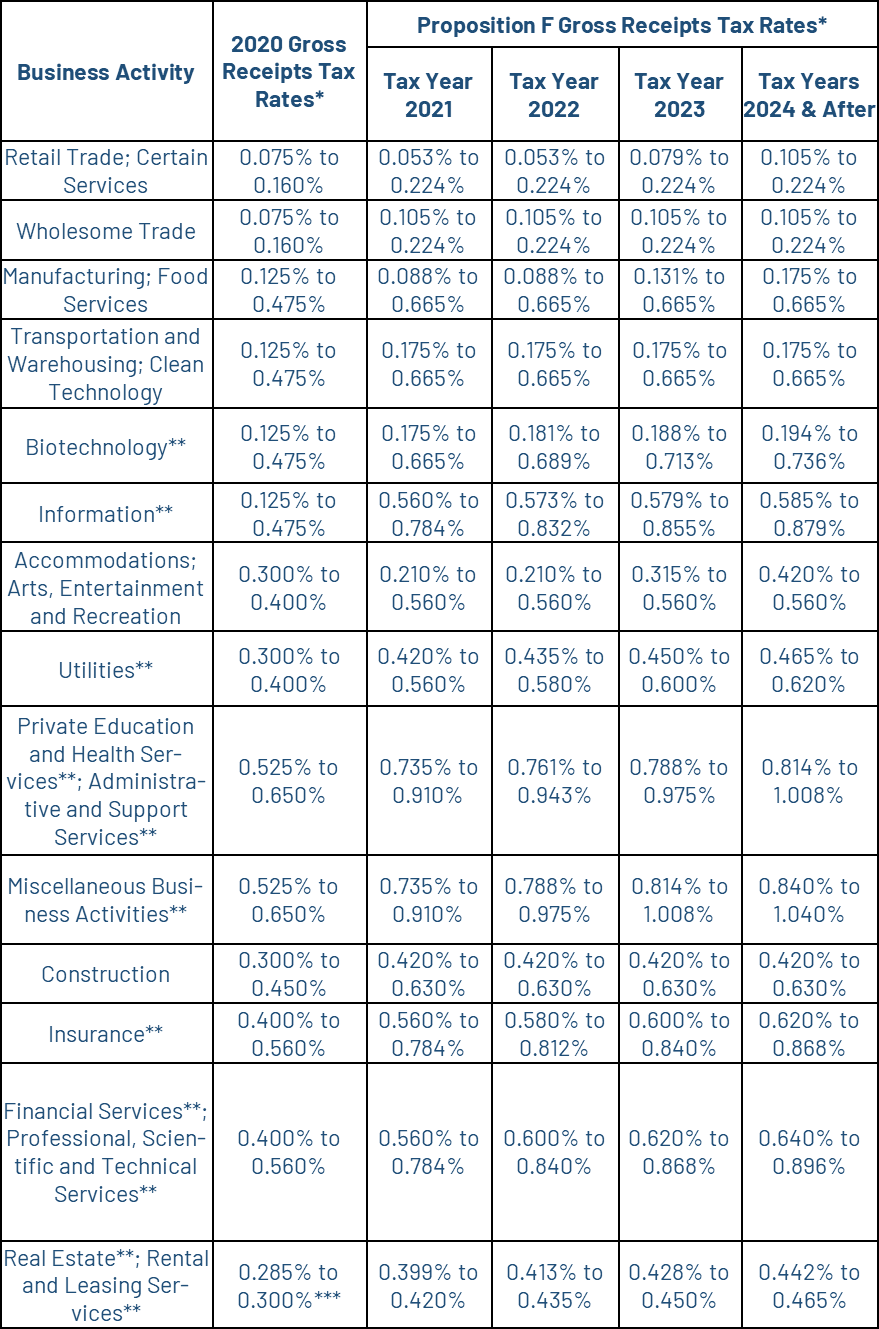

Gross Receipts Tax Gr Treasurer Tax Collector

San Francisco Feels A Tax Base Chill With First Drop In 25 Years Bloomberg

Sales Gas Taxes Increasing In The Bay Area And California

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

San Francisco Sales Tax Rate And Calculator 2021 Wise

Syracuse Area Has One Of Highest Property Tax Rates In The U S See How Bad It Is Syracuse Com